The coffee sector is facing several sustainability challenges, yet most companies do very little to address sustainability.

Like millions of people across the planet, I start my day with a cup of coffee or two. Most of the days, I brew it myself the old-fashioned way, other days I buy it from my favorite coffee roaster in town. To satisfy our habit, millions of tons of coffee are produced each year, making multinational coffee roasters amongst the biggest corporations on the planet. With a growing middle-class and coffee consumption becoming the norm in countries where the drink was unheard of a decade ago, demand is set to rise even further.

Coffee production provides a livelihood for more than 25 million people worldwide, most of whom are smallholder farmers. All the while, climate change is expected to severely affect coffee production, and the coffee sector has also faced criticisms on both environmental and social grounds. With these challenges in mind, we decided to try to understand what the sector is doing to address sustainability challenges.

In our research, we analyse how the coffee sector approaches sustainability. How many companies are involved with sustainability activities? Which problems do they address? Which type s of companies address sustainability and why do they choose to do so? We examine the sustainability efforts of a large pool of companies active in the coffee sector. We collected as much information as possible on each company and then trawled through the companies’ websites and reports to identify how they address sustainability.

So, what did we find?

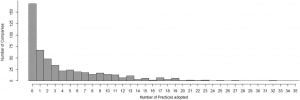

Firstly, company efforts to address sustainability vary greatly. On average, each company adopts 4.21 sustainability practices, such as using renewable energy or having a waste management policy. Slightly more attention is paid to socio-economic (2.32) than environmental (1.89) practices. The relatively low adoption of sustainability practices reflects the low total spending on sustainability, estimated in the early 2010s to be only $350 million across the entire sector. This corresponds to less than 0.15% of total sector size which is greater than $200 billion.

Most companies adopt no or very few sustainability practices, while a minority – the sustainability leaders – adopt half or more of all practices included in the study.

Secondly, companies are not equally committed to sustainability. A third of the companies do not adopt any sustainability practices at all, thus forming a large group of laggards. Another third of the companies analyzed are relatively weak participants in sustainability efforts, adopting a few sustainability practices, but generally not addressing sustainability. The final third of companies reports tangible commitments to sustainability, adopting several sustainability practices and standards.

Thirdly, company characteristics influence sustainability commitment. Large companies tend to adopt more sustainability practices, while smaller companies are more likely to be transparent on supply-chain partners and prices. Companies do not place equal importance on all sustainability practices. For example, while more than 30% of companies donate to charity, only 5% explicitly address climate change and only 13% of companies have a “No child labor”-policy. We also found indications of greenwashing. Some companies claim to be ‘sustainable’, yet adopt few sustainability practices and no external standard. They are thus at risk of ‘greenwashing’, as their sustainability claim is not matched by their actual sustainability activities.

Finally, we identified two diverging sustainability strategies. Companies adopting internal practices address sustainability ‘hands-on’, directly deciding on which sustainability areas to target within their company and value chain. By contrast, companies adopting external certification standards address sustainability ‘hands-off’, as their sustainability efforts are defined through the scope of the adopted standards. Due to their greater financial resources and enforcement capacity, large, risk-aware companies tend to conduct ‘hands-on’ governance, designing and implementing internal sustainability practices along their value chain. By contrast, small, consumer-facing companies and producers rely on ‘hands-off’ governance, adopting external certification standards to ensure that sustainability issues are addressed beyond their own company.

What does this mean for company strategies?

Our results show that sustainability efforts in the coffee sector are differentiated not only between those companies addressing sustainability and those not, but also within the sustainable segment (‘hands-on’ versus ‘hands-off’ strategies). However, with a third of all companies addressing sustainability and new differentiation strategies—for example, direct trade and transparency—embraced by the most innovative actors, mainstream companies face increasing pressure from stakeholders to also adopt sustainability policies to reduce risks and increase competitiveness. This leads to a convergence around sustainability, which becomes one of the ‘rules of the game’ in the coffee sector.

Sustainability convergence at the sector-level and differentiation at the company-level signals a need for common coffee sustainability indicators, which are consistent with the SDGs. In addition, mandatory reporting requirements would increase transparency and enable comparison of company efforts, ensuring that commitments actually result in greater sustainability. At the same time, increased adoption of certification standards by those less able to engage across the value-chain could stimulate demand for certified products, contributing to farmer income and improved environmental outcomes.

Whether increased sustainability in coffee value chains will affect overall sector practices or remain a niche activity depends on stakeholders’ demanding this change and lead firms making sustainability a central aspect of their business. One thing is sure, though: With increasing awareness of sustainability challenges among consumers and other stakeholders and new information technologies arising, sustainability innovations are likely to continue to transform the coffee sector.